Knowing Your Greeks

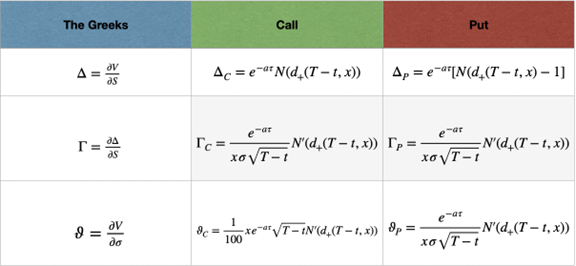

In finance, “Knowing your Greeks” is a slang term for understanding the sensitivity of an option’s price to the underlying factors driving its value. For example, Delta is the first derivative: the change in the price of the option relative to the change in the stock price. It’s helpful, when dealing with high-volatility assets like options to understand these derivatives, as they form the building blocks of dynamic pricing models.

This is the trivia you learn while getting a master’s in finance. Much of it turns out to be quite useless in the world corporate finance when you’re skimming page 412 of some middle market company’s trial balance for halfway-plausible EBITDA addbacks. But some of it sticks and you end up thinking about it as you make your way through life.

As a startup founder – I laser focus on gamma: the second derivative.

The Possibility of Exponential Growth

Startups are fundamentally about exponential growth. Investments in startups are call options on exponential growth. Every useful framework in startup-land is about finding the magic ingredients to enable the possibility of exponential growth.

-

Can you zero in on where the market is pulling?

-

Can you identify your target customer

-

Who are they

-

What are they buying

-

Why are they buying (any why from you)

-

-

Is this a multi-billion dollar total addressable market?

-

Multi-billion dollar serviceable addressable market?

-

Multi-billion dollar serviceable obtainable market?

-

-

-

Given those prerequisites, do you have a strong and proven maniacally-focused team that can execute technologically and commercially?

That’s just the table stakes. And it’s all shorthand for understanding whether your startup happens to exist in a petri dish with all the right ingredients for exponential growth.

The shorthand for this in finance is gamma. The question is not, “How quickly is your startup growing?” but “How quickly is it increasing its growth rate?

Sometimes maximizing gamma means zooming out and sometimes it means fingers to keys. Because no matter where you land on sussing out the abstract nature of growth, yeah yeah philosophy etc, there are only a few boots-on-the-ground levers that can be pulled.

The main ones:

-

Push commits

-

Book meetings

-

Place content

Simplified further, I'd say there's really just two things that matter:

-

Hacking

-

Hustling

Done correctly, word gets out that a problem is solved. The combined actions 1-3 above lead to paying customers. Their satisfaction travels to new customers by word of mouth, a lagging measure of which is your "NPS." An elegant technological solution to a problem is replicated digitally at de minimis marginal cost (90%+ GM SaaS babyyy) until the problem ceases to exist in its prior form and in its ashes stands the new enterprise.

This is the story of all successful software. I intend to make it our story as well.

This week we primarily pushed commits (12) and booked meetings (5). We did not place much content, although the plan is to do so in the near future (across all of your favorite social platforms!). At that point, you may be asked to “like and subscribe.” But for now the only content we are placing is this weekly update.

Keep hacking, keep hustling,

Joseph Frantz

CEO, TimeSentry AI

Leave a Comment